In 2007, India moved from the low-income to lower-middle-income category, as per the World Bank’s classification of countries by income. With clear aspirations to graduate into the higher brackets of income, what will it take for India to make it? Speaking at the launch event of Ashoka’s University’s Isaac Centre for Public Policy (ISPP), experts including Rakesh Mohan (former Governor of the Reserve Bank of India), Anup Wadhawan (former officer of the Indian Administrative Service) and Prachi Mishra (Chief of the Systemic Issues Division, International Monetary Fund) discuss ideas for achieving faster structural transformation of the economy, strengthening State capacity, catching the bus for labour-intensive manufacturing, empowering urban local government, and consolidating public debt.

For FY2024-25, the World Bank has defined ‘low income’ as per capita GNI (gross national income) below US$1,135, ‘lower-middle income’ between US$1,136 and US$4,465, ‘upper-middle income’ in the range of US$4,466-13,845 and ‘high income’ as above US$13,845. With a per capita GNI of US$2,500, India falls in the lower-middle-income bracket. Faster economic growth combined with slowing population growth have enabled India to accelerate per capita income growth in recent decades, and the country crossed over from low-income to the lower-middle income category in 2007.

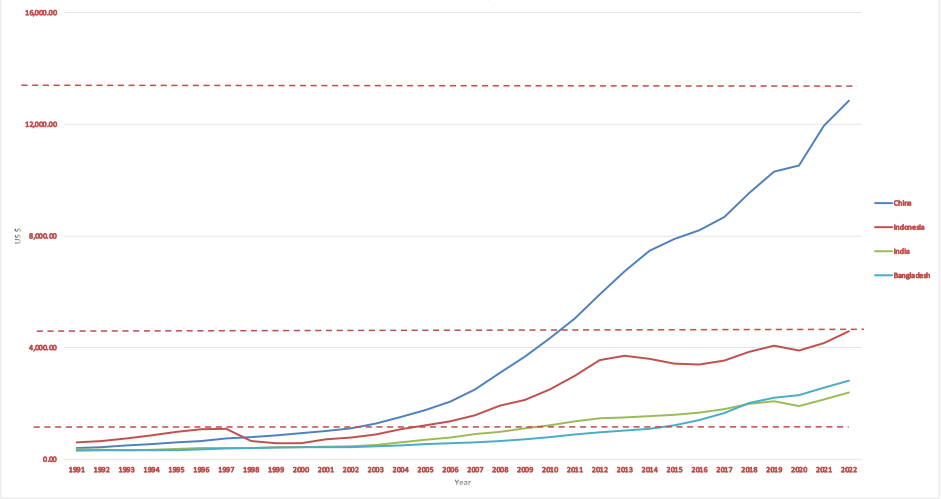

Figure 1 below depicts India’s per capita income trajectory, and how it compares with a selection of other developing countries. Notably, at US$12,850, China is close to the threshold of the high income category. While China spent roughly nine years as a lower-middle-income country, India has had that status for almost twice as long and is still far from the minimum requirement for upper-middle-income classification.

Figure 1. GNI per capita, for a selection of developing economies

Source: World Bank.

Note: The red horizontal lines indicate the World Bank thresholds for classifying countries by per capita income. The thresholds are adjusted for inflation every year, and the thresholds in this graph are based on the current values.

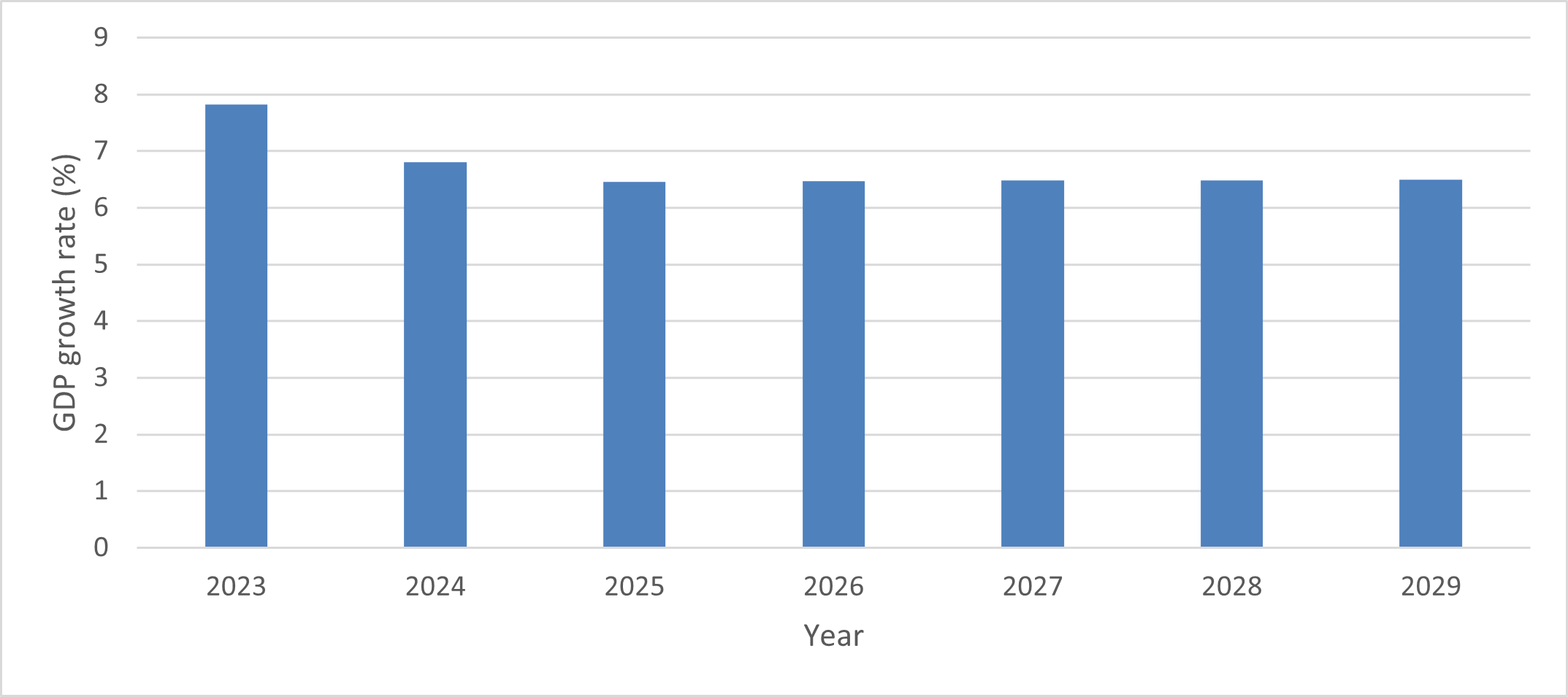

According to the Crisil India Outlook Report (2024), if India’s gross domestic product (GDP) expands by an average of 6.7% during 2025-2031, the country will enter the upper-middle-income category in the next seven years. As per forecasts by the International Monetary Fund (IMF), India can maintain growth rates in the range of 6.4-6.8% over the next five years (Figure 2).

Figure 2. India’s growth projections for the next five years

How can India achieve and sustain high growth rates, while also ensuring that the benefits of growth are spread more evenly among its population? Speaking at the launch event of Ashoka’s University’s Isaac Centre for Public Policy (ICPP) on 24 April 2024, experts including Rakesh Mohan (former Governor of the Reserve Bank of India), Anup Wadhawan (former officer of the Indian Administrative Service) and Prachi Mishra (Chief of the Systemic Issues Division, International Monetary Fund) discuss ideas for achieving faster structural transformation of the economy, strengthening State capacity, catching the bus for labour-intensive manufacturing, empowering urban local government, and consolidating public debt.

Need for more agile and wise public policy

The global context in which India is to make its journey from lower-middle-income to higher levels appears to be particularly challenging. Citing examples of the Covid-19 pandemic, ‘backlashing globalisation’, and the extended Ukraine War, Dr Mohan contended that the circumstances of the past two to three years have not been seen at least since World War II. There has been a breakdown of global order – both economic and political – indicated by governance issues in institutions such as the World Bank and IMF as the increasing weight of non-Western countries has not been recognised in their structures. With regard to the World Trade Organization (WTO), there has been a lack of global cooperation, for example, in the case of Covid vaccines for poor countries. High indebtedness of both developing and advanced economies raises the likelihood of higher real interest rates in the years to come, with potential widespread impacts. There are problems with reporting and data vis-à-vis the large number of deaths in the ongoing wars, contributing towards ineffective global governance. Hence, there is a pressing need for public policy to be a lot more agile, flexible, knowledge-based and wise.

Faster structural transformation

Dr Mohan cautioned against remaining trapped in the middle-income category. Historically, while many countries have grown fast and reached middle-income levels, very few have broken into high-income levels. Fast-growing economies typically achieve significant structural transformation from rural pursuits to more productive, urban activities – largely enabled by labour-intensive, export-oriented manufacturing. Once a certain level is reached, the wage advantage disappears, and continued growth warrants higher technology levels1.

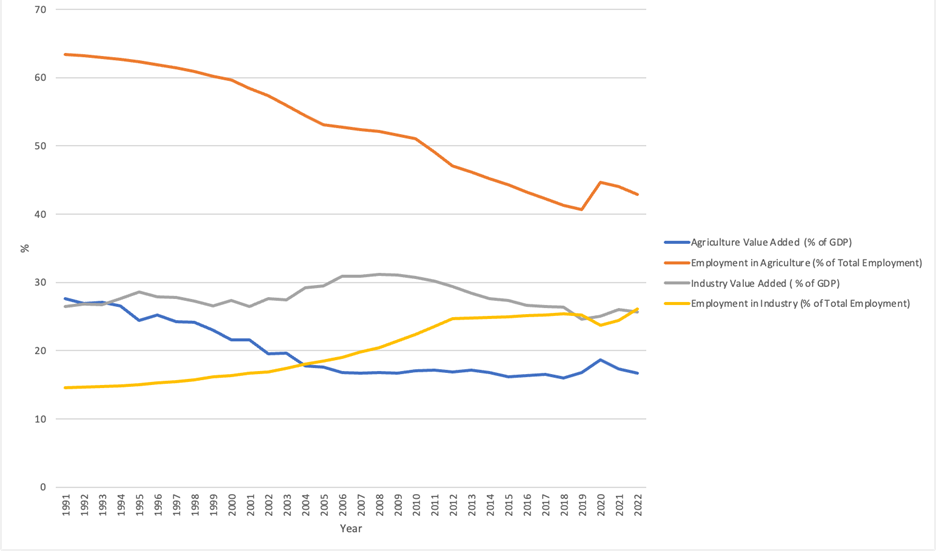

However, India’s problem is that the rural-to-urban structural transformation and corresponding changes in the employment structure, have been very slow. For example, since achieving Independence in 1947, the share of agriculture in value added has declined from 55% to 16.7%, while the sector’s share in employment remains around 43%. The share of industry has stagnated at 24-25%, which is unusual for a country at this level of development (Figure 3).

Figure 3. Share in value added and employment of agriculture and manufacturing

It is commonly believed that India is rapidly undergoing urbanisation. In this context, Dr Mohan pointed out that the net rural-urban migration component of urban growth is only 20%, with the rest coming from natural population growth in urban areas and expansion of neighbouring towns. This is attributable to insufficient labour-intensive manufacturing, resulting in low urban growth and productivity.

Therefore, before India can graduate from low-wage, labour-intensive manufacturing to higher-level manufacturing, it first needs to get into the former. With sui generis issues, India needs to chart its own course, one which needs a major change in gear in development strategy and governance.

Strengthening State capacity

Dr Mohan highlighted the need to strengthen State capacity in India as central to the goal of faster growth. The private sector is constrained due to the lack of public services that only the State can provide or facilitate. In particular, there is a need to transform the colonial set-up of administration, in order to meet the neo-developmental needs of a middle-income country. The inattention to nutrition, health, education and research and development (R&D) is linked to the barriers on labour-intensive manufacturing and creation of quality employment outside agriculture.

Further, the government is understaffed at all levels. Dr Wadhawan added that blind downsizing has depleted departments of capacity and talent in the upper echelons. It is not the case that the bureaucracy is unaware of what needs to be done for development. Rather, there are issues such as risk aversion among officials and their political masters in terms of not wanting to potentially cause catastrophic disruption or go a few steps back in the quest for reform. Together with the stranglehold of political economies and vested interests, the outcome is a business-as-usual situation.

Dr Wadhawan also raised the matter of the productivity of government spending, which is often wasteful and/or generates low returns. Devices such as public-private partnerships involving outcome-based contracts, social accountability measures, digitisation of processes, and empowerment of consumers, may be used in the social sector – similar to what is done for physical infrastructure. Besides, subsidy spending that is targeting equity ends up compromising efficiency by bringing in distortions, and alternatives should be considered.

Catching the bus for labour-intensive manufacturing

India’s labour force participation stands at 50-55%, lower than not only the global average but also relative to other developing countries. Official data show that between 2014-15 and 2021-22, there were 220 million applications for just 700,000 central government jobs advertised – this, along with other similar statistics, are indicators of real problems. Unemployment is greater among the educated since they can afford being out of work for a period of time, while the poor cannot. This may be explained by the huge expansion of low-quality higher education, and no corresponding job creation for the millions of youths graduating out of college.

Dr Mohan refuted the popular perception that India has missed the bus for labour-intensive manufacturing and hence the focus should be on services. Even if India grows at 4-5% per year, there can be far more incremental demand for consumer goods than was the case in Europe and the United States – which fueled China’s growth. However, enhancing competitiveness requires the State to provide or facilitate public services for human capital development. Dr Wadhawan added that the thinking that catching the services bus is easier is incorrect: it will be missed for the same reasons as manufacturing. Services success stories have been relatively narrow in terms of scale and scope – employment generation and GDP contribution – and there are constraints to transforming to the cutting edge of IT services, for instance.

As per Dr Wadhawan, there is no getting away from putting the huge, under-employed workforce on to the factory floor in the first instance and then logically graduating to services. This is how the world has done it and there is no Indian exceptionalism. Further, it is important to improve the investment climate by creating ‘islands of excellence’ with global best practices in regulation, policy, infrastructure, etc. While it is commonly believed that the world is becoming protectionist and that trade opportunities are shrinking, the reality is that global value chains and investment flows are being realigned and de-risked, with a move mostly towards ‘friend-shoring’ rather than a lot of onshoring. India fits the frame and even minimal improvements in competitiveness can lead to huge gains in exports.

Empowering urban local government

According to the 2011 Census, there are 52 Indian cities with a population of over one million each. Recognising cities as large organisms involving complex management of urban transport, water and sanitation, health and education, and so on, Dr Mohan advocated for greater fiscal empowerment of urban local bodies. While this has been recommended by several finance commissions, not much has been done yet. He emphasised the need to strengthen capacity and change the way in which cities are run.

It ought to be made more prestigious and interesting to work in the urban government, across levels of legislature, bureaucracy or service provision. Urban government can tap into the huge expansion of the pool of educated youth – even if low quality – and provide them with training.

Consolidating public debt

Sovereign debt levels across the globe, including in India, have reached unprecedented levels in the post-pandemic period. This may be explained by a combination of three factors: higher government spending in response to Covid-19, low economic growth rates, and high interest rates across economies to combat inflation in the aftermath of the pandemic. In a recent ICPP policy brief, Prachi Mishra and Nikhil Patel of the IMF, conduct simulation exercises which suggest that if India can keep its primary and fiscal deficits under 1.7% and 5.9% of GDP respectively every year, debt ratios can reduce to a desirable level of 70% in the next 10 years.2

Speaking at the event, Dr Mishra pointed out that the problem is more severe for India because global financial conditions are tighter, growth prospects are weaker, and the dollar is stronger. The only solution for gradual debt reduction is consolidation. The 15th Finance Commission and the FRBM (Fiscal Responsibility and Budget Management Act, 2003) Review Committee sought to put a structure in place, and the time is right to revisit these. Moreover, as we are coming out of a global shock, compliance with related rules is quite weak throughout the world. The important questions are, how do we design rules such that there is greater compliance, and how do we think about relevant financial institutions. In this regard, the FRBM Review Committee and the 15th Finance Commission had recommended setting up of a ‘fiscal council’, with both an ex-ante forecasting role and an ex-post monitoring function.

India stands at a pivotal moment, poised for transformational growth and development. The country has done new, innovative things such as establishing Jan Dhan Yojana, Insolvency and Bankruptcy Code, Swachch Bharat Mission, etc., and should press on with discontinuous change in order to avoid stagnation.

ICPP at Ashoka University is an attempt to build India’s leading public policy centre – recognised for generating ideas and research on Indian public policy. Learn more about the Centre on their website

I4I is now on Substack. Please click here (@Ideas for India) to subscribe to our channel for quick updates on our content

Notes:

- In this context, it is interesting to consider a contradictory empirical finding by Patel, Sandefur and Subramanian (2021) who find that since the mid-1990s, middle-income countries have outpaced economic growth rates of developed countries. Rather than being stuck in a trap, the former have in fact been characterised by lower volatility and persistent growth.

- This assumes real GDP growth rate of 7% and real interest rate of 2%.

Further Reading

- Patel, Dev, Justin Sandefur and Arvind Subramanian (2021), “The new era of unconditional convergence”, Journal of Development Economics, 152: 102687.

12 June, 2024

12 June, 2024

Comments will be held for moderation. Your contact information will not be made public.