The recent upsurge in global prices of essential commodities of food and fuel, warrants an analysis of the distributional ramifications, especially within developing economies. This article examines Indian household consumption and income data, and finds that on average, increases in these prices adversely affects consumption in the country. While rise in food prices unequivocally exacerbates consumption inequality, the effect of oil prices is more nuanced.

In recent times, there has been a notable upsurge in global food and fuel prices, sparking extensive deliberations in both policy circles and popular media. Notably, publications such as the World Economic Outlook by the International Monetary Fund (IMF), in its April and July 2022 editions, have focused on the distributional ramifications of these global price shocks, particularly within emerging market and developing economies.

The heightened attention to this issue can be attributed to several factors. First, food and fuel are commonly regarded as essential commodities for the poor. Consequently, any increase in their prices incurs significant costs as substituting away from them is difficult. Second, given that low-income households constitute a substantial portion of the population in emerging economies, the impact of rising global food and fuel prices can be especially pronounced, amplifying its aggregate effects in these countries (De Winne and Peersman 2021).

Even though this issue is both topical and policy relevant, we did not find rigorous academic evidence on the distributional effects of various global price shocks in the context of emerging economies. In new research (Bhattarai, Chatterjee and Udupa 2024), our key inquiry in the context of India is whether global food and fuel price shocks have heterogeneous consumption effects along the income distribution of households. Another important aspect of our research question is whether food and/or fuel actually are essential consumption goods for Indian households.

Existing research

There is a large and influential literature that studies the macroeconomic effects of commodity price changes, with a focus on oil prices (Hamilton 1983, Kilian 2009, Baumeister and Hamilton 2019, Känzig 2021). There is also a smaller but growing literature on macroeconomic effects of food price fluctuations (Peersman 2022). One key finding of this body of work is that not all oil shocks are alike in terms of their macroeconomic consequences. After all, global prices are equilibrium outcomes shaped by forces of supply and demand, and the macroeconomic effects critically depend on whether demand or supply drives oil price fluctuations. This literature, however, is silent both on the distributional consequences of such global price shocks as well as on whether the distributional consequences depend on the underlying factors that drive such price changes.

There is an evolving literature that studies distributional effects of carbon pricing (Känzig 2021), and commodity price shocks in general (Pallotti et al. 2023, Cardoso et al. 2022) especially in the aftermath of the 2022 global inflation episode. However, this literature is largely focused on advanced economies. It also often assumes fuel to be an essential consumption good with inelastic demand (that is, not very responses to changes in prices), and as such, effectively treats oil price fluctuations as an unanticipated income shock for households (Gelman et al. 2023). We depart from this premise in various important ways. First, our context is that of an emerging economy, where we aim to compare distributional effects of food and fuel price rises and investigate whether these distributional effects depend on the nature of the shock (supply or demand) that drives such price changes. Second, we do not assume ex-ante that food and/or fuel are essential, but instead combine insights from a model that features a ‘non-homothetic’1 demand structure (as in Matsuyama 2022) and our empirical results to formally test whether food and/or fuel are essentials in consumption.

Data and methodology

We measure global food and fuel prices as per the IMF Food Price Index and Brent Crude Oil Price at monthly frequency, from 2014 to 2019. In this sample, both oil and food prices show considerable variation, and oil prices, on average, are three times as volatile as food prices. These global price changes may signify alterations in global demand, or supply and demand specific to each commodity. While estimating the causal impact of global price changes on household consumption in India, it is critically important to be aware of potential ‘omitted variable bias’ (local shocks can be correlated with global prices and local consumption) or ‘reverse causality’ (wherein Indian market conditions could affect global prices and local consumption). To overcome these challenges, we employ an instrumental variable (IV)2 analysis where we instrument the price changes by the corresponding supply-side variation, ensuring that we leverage exogenous shifts in commodity prices to evaluate their effects on the Indian economy.

This brings us to our key research inquiries: What are the dynamic distributional effects of global food and oil shocks on Indian household consumption, and what are the potential channels of transmission in such a dynamic setting? To answer these questions, we use rich household consumption and labour earnings monthly panel data, available through the Consumer Pyramid Household Survey (CPHS) dataset, covering over 150,000 households monthly since 2014 on detailed categories of consumption and income.

To estimate the effects of global commodity price changes on local prices (the so-called “pass-through” of foreign prices on domestic prices) as well as to deflate nominal expenditures, we use state-region level monthly data on different components of the Consumer Price Index (CPI), available from the Ministry of Statistics and Programme Implementation.3

Our empirical framework is a panel IV local projection, where global food and fuel price changes are instrumented by the corresponding supply shocks to isolate exogenous variation. Our empirical framework allows us to estimate the dynamic causal effects of global price changes on household consumption in the form of ‘impulse response functions’ (IRFs).4 Central to our analysis is the feature that we allow the impulse responses to differ by the income groups of the households such that we can estimate heterogeneous effects.

Key findings

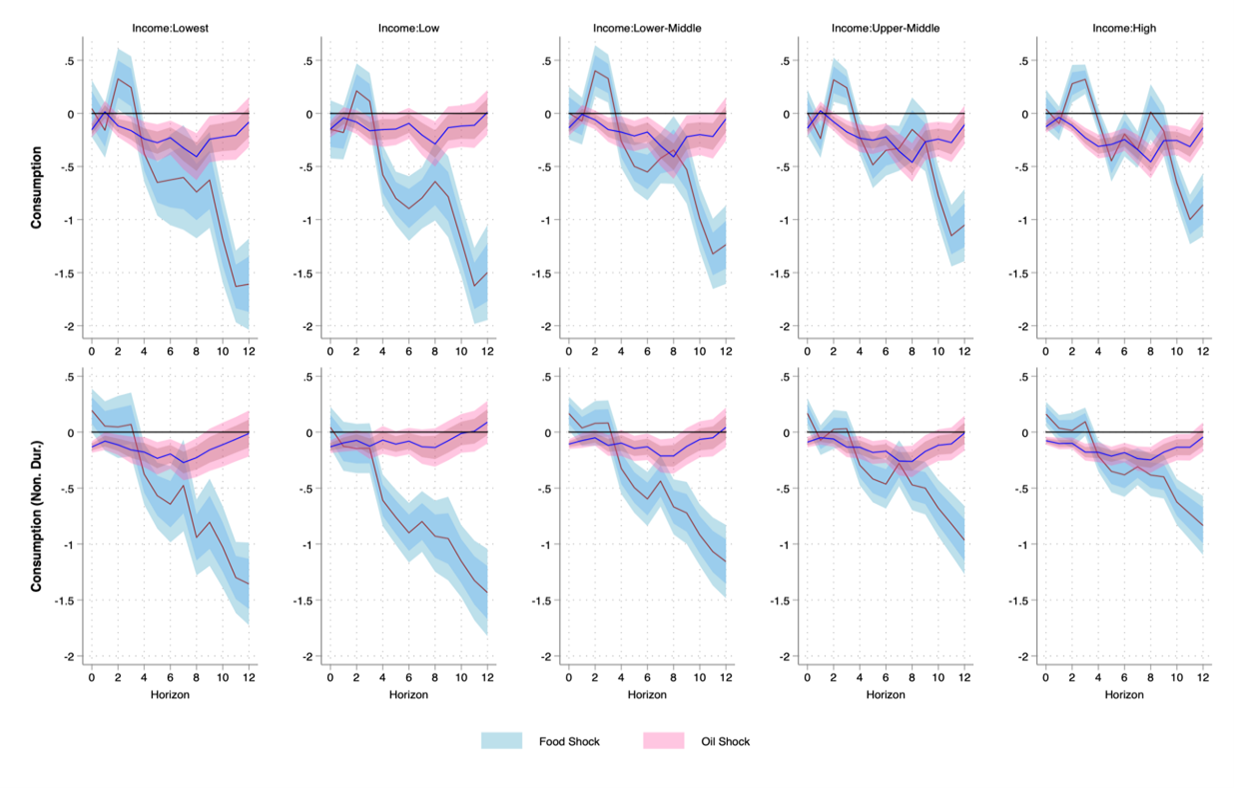

As illustrated in Figure 1 below, there is a clear decline in household real consumption in response to increased food prices. Importantly, the effects are monotonically larger on poorer households, implying an increase in consumption inequality with an increase in global food prices. These effects are also economically meaningful: an average food price increase of 3% results in over a 4% decline in real non-durable consumption for the poorest households, a 3% decline for middle-income groups, and a decline of more than 2.5% for wealthier households.

Figure 1. Response of consumption to global oil and food price shocks, by income quintiles

Notes: (i) Here we report cumulative IRFs where external shock is the log of changes in global oil and food price, which are instrumented by the corresponding supply shocks and the dependent (outcome) variable is the log of changes in household consumption. (ii) The light blue/pink region around the trend lines is the 90% confidence interval and the dark blue/pink region is the 68% confidence interval. A confidence interval is a way of expressing uncertainty about estimated effects – specifically, it means that if the study was repeated over and over with new samples, 90% and 68% of the time, respectively, the calculated confidence interval would contain the true effect.

A rise in global oil prices similarly results in a noticeable decline in overall household consumption in India, albeit with a smaller elasticity (or magnitude of response). Significantly, the impact on inequality is less definitive, as both ends of the income distribution are equally vulnerable to the effects of rising global oil prices. A 10% oil price shock leads to a nearly 2% reduction in real non-durable consumption for both these groups at opposite ends of the income distribution. Intriguingly, we also find that while the effects of global food price fluctuations tend to be more pronounced among the rural poor, global oil price changes have a greater impact on the urban population in India.

It is crucial to highlight that these heterogeneous effects, particularly concerning the oil price shock but also regarding the food price shock, hinge significantly on the disentanglement of demand and supply shocks. This underscores the notion that, akin to the aggregate macro effects examined in the prior literature, “not all oil price shocks are alike” when it comes to their distributional consequences.

To delve into the underlying the mechanisms behind these heterogeneous consumption effects across the Indian population, we set up a dynamic consumption savings model where consumers have varied initial portfolio holdings and labour income/earnings. This set-up allows us to investigate rigorously whether these consumption components can be classified as essentials, in the sense that relative expenditure on such items is affected by total expenditure and not just relative prices.

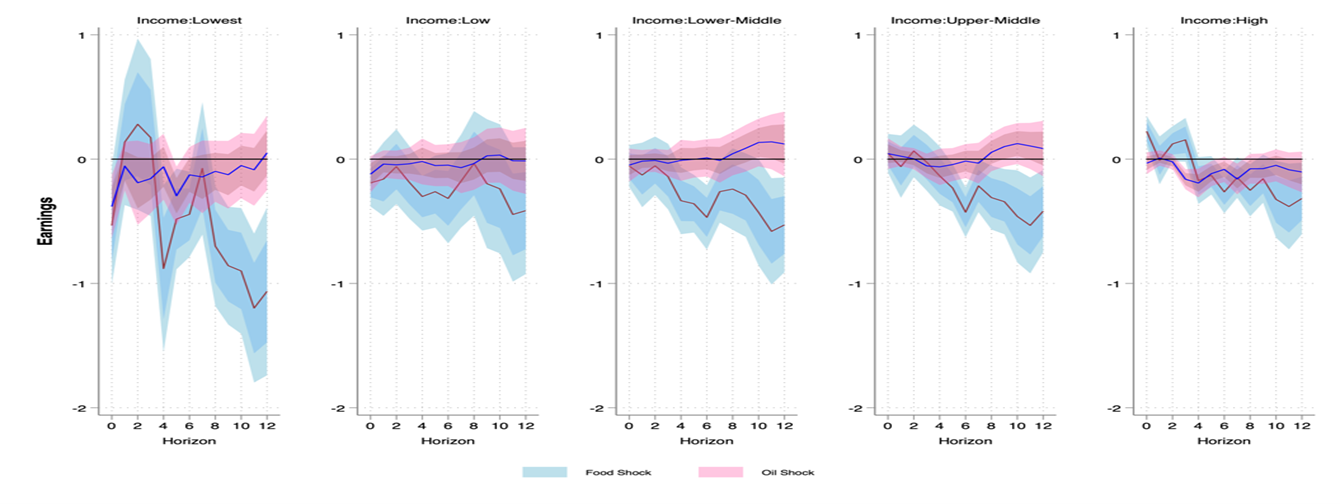

Figure 2. Response of earnings to global oil and food price shocks, by income quintiles

Notes: (i) Here we report cumulative IRFs where external shock is the log of changes in global oil and food price, which are instrumented by the corresponding supply shocks and the dependent (outcome) variable is the log of changes in household real earnings. (ii) The light blue/pink region is the 90% confidence interval and the dark blue/pink region is the 68% confidence interval.

We first demonstrate in Figure 2 that the heterogeneous pattern of effects on real earnings largely mirrors that of consumption. While all households experience a decline in real earnings stemming from increased food prices, the impact is consistently more pronounced among lower-income households in a monotonic way. Moreover, a rise in oil prices erodes the real earnings of both the poor and the rich. These heterogeneous fluctuations in real earnings may stem from the varying exposure of different occupation/industry groups to macroeconomic contractions induced by supply shocks, or from differing levels of nominal wage rigidity.

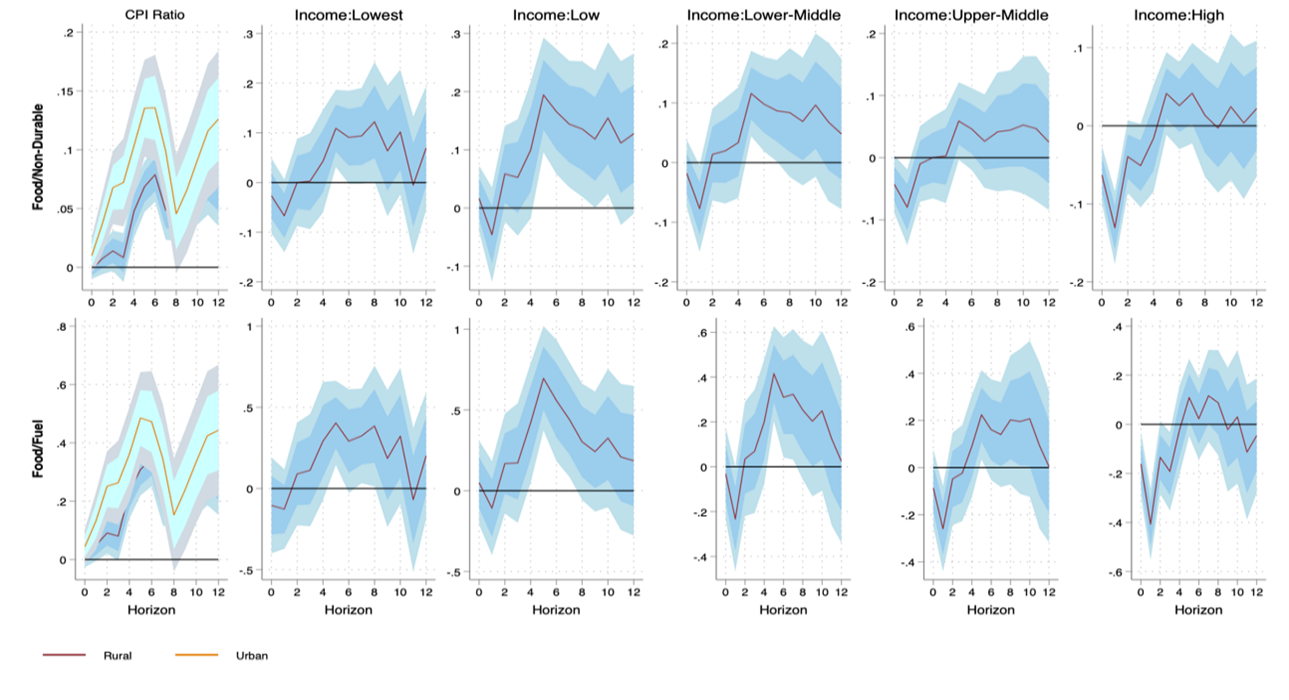

Next, we find compelling evidence that global price shocks pass-through to Indian prices. Global food price increases raise the food component of CPI (which makes up around 46% of the total weight), which in turn affects headline CPI strongly. Moreover, it makes food and its various sub-components relatively more expensive compared to fuel. Global oil price increases elevate local fuel prices as well as the relative price of fuel compared to food.

Importantly, the impact on relative expenditure on food shows strong patterns of non-homotheticity. As we mentioned above, a rise in global food prices raises relative prices of food relative to fuel. Conventional expenditure-switching effects would suggest a decrease in the relative expenditure on food. As shown in Figure 3, however, following an increase in global food prices that increases the relative price of food (compared to non-durable prices as well as fuel prices), both the food-to-fuel or food-to-non-durable relative expenditure ratios register a rise for the lower-income groups. This implies that these items are certainly essential in consumption for the poor. Indeed, a formal econometric analysis reveals that food is an essential consumption, broadly, for all the income groups in India.

Figure 3. Responses to global food price shock, by income quintiles

Notes: (i) Here we report cumulative IRFs where external shock is the log of changes in global food price, which is instrumented by the corresponding supply shocks and the dependent (outcome) variable is the log of changes in household nominal expenditure ratios and relative prices at the state-geography level. (ii) The light blue region across the five income groups is the 90% confidence interval and the dark blue region is the 68% confidence interval.

Concluding remarks

Our study intends to advance understanding of the distributional consequences of exogenous fluctuations in global commodity prices. Such consequences differ by the commodity that experiences price changes, and critically, by whether we separate out demand or supply shocks that underlie such price changes. Exogenous global food and oil price changes have deep-set patterns of heterogeneous impact on consumption and real purchasing power of labour earnings, and a strong pass-through on local Indian consumer prices. On average, both increases in global food and oil prices adversely affect consumption in India.

With regard to inequality, it is evident that global food price increases unequivocally exacerbate consumption inequality, while the effects of global oil price increases are more nuanced. Finally, our findings underscore the essential role of food in the consumption basket for all households – as is expected for lower-income emerging economies such as India.

I4I is now on Substack. Please click here (@Ideas for India) to subscribe to our channel for quick updates on our content

Notes:

- Non-homothetic demand structure means a demand system where relative demand depends not just on relative price, but also on the level of expenditure.

- Instrumental variables could be used in empirical analysis to address concerns about omitted variable bias or reverse causality. The instrument is correlated with the explanatory variable (in this case, global food and fuel prices), but does not directly affect the outcome of interest (household consumption). The instruments can therefore be used to measure the causal relationship between the explanatory factor and the outcome of interest.

- In using official government sources on detailed consumer price indices for these purposes, we follow the suggestion by Deaton (2019).

- Impulse response functions estimate the dynamic causal effects of structural shocks on the respective outcome variables.

Further Reading

- Baumeister, Christiane and James D Hamilton (2019), “Structural Interpretation of Vector Autoregressions with Incomplete Identification: Revisiting the Role of Oil Supply and Demand Shocks”, American Economic Review, 109(5): 1873-1910.

- Bhattarai, S, A Chatterjee and G Udupa (2024), ‘Food, fuel, and facts: Distributional effects of global price shocks’, Working Paper. Available here.

- Cardoso, M, C Ferreira, JM Leiva, G Nuño, Á Ortiz, T Rodrigo and S Vazquez (2022) ‘The Heterogeneous Impact of Inflation on Households’ Balance Sheets’, Red Nacional de Investigadores en Economıa Working Paper 176.

- De Winne, Jasmien and Gert Peersman (2021), “The adverse consequences of global harvest and weather disruptions on economic activity”, Nature Climate Change, 11(8): 665-672.

- Deaton, A (2019), The Analysis of Household Surveys (Reissue Edition with a New Preface): A Microeconometric Approach to Development Policy, World Bank Publications.

- Gelman, Michael, et al. (2023), “The Response of Consumer Spending to Changes in Gasoline Prices”, American Economic Journal: Macroeconomics, 15(2): 129-160.

- Hamilton, James D (1983), “Oil and the Macroeconomy since World War II”, Journal of Political Economy, 91(2): 228-248.

- Känzig, Diego R (2021), “The Macroeconomic Effects of Oil Supply News: Evidence from OPEC Announcements”, American Economic Review, 111(4): 1092-1125.

- Känzig, DR (2021), ‘The Unequal Economic Consequences of Carbon Pricing’. Available at SSRN 3786030.

- Kilian, Lutz (2009), “Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market”, American Economic Review, 99(3): 1053-1069.

- Matsuyama, K (2022), ‘Non-CES Aggregators: A Guided Tour’, Working Paper. Available here.

- Pallotti, F, G Paz-Pardo, J Slacalek, O Tristani and GL Violante (2023), ‘Who Bears the Costs of Inflation? Euro Area Households and the 2021–2022 Shock’, NBER Working Paper

- Peersman, Gert (2022), “International Food Commodity Prices and Missing (Dis)Inflation in the Euro Area”, The Review of Economics and Statistics, 104(1): 85-100.

20 June, 2024

20 June, 2024

Comments will be held for moderation. Your contact information will not be made public.