Sharmila Kantha outlines why the high share of petroleum products in India's exports is a concern – particularly considering the declining trend in India's oil and gas production and fluctuating global demand. She shares some trends in the volume and value of India's oil exports and imports, as well as statistics on the key countries with which it trades. She concludes with some policy suggestions to increase production and ensure the stability of India's oil exports.

Mineral fuels and products have figured heavily in India’s export profile for most of the last decade and have occupied over 20% share of its exports for several years during the period between 2012-13 and 2022-23.

After almost a decade of moderate export growth, India’s exports achieved new peaks during FY2021-22 and 2022-23. However, we are witnessing a contracting trend in the first half of 2023-24 by close to 9% over the same period in previous year. The major contributor to the export contraction during April-September 2023 (over the same period in 2022) is petroleum exports – while non-oil exports declined by 6.3%, petroleum exports plunged by as much as 17.6% (Table 1).

Table 1. India’s exports during April-September 2022 and 2023 (in billion US$)

|

|

April-September 2022 |

April-September 2023 |

% Growth |

|

Total exports |

231.73 |

211.40 |

-8.8% |

|

Non-petroleum exports |

180.88 |

169.51 |

-6.3% |

|

Petroleum exports |

50.85 |

41.89 |

-17.6% |

|

Share of petroleum exports in total exports, % |

21.9% |

19.8% |

|

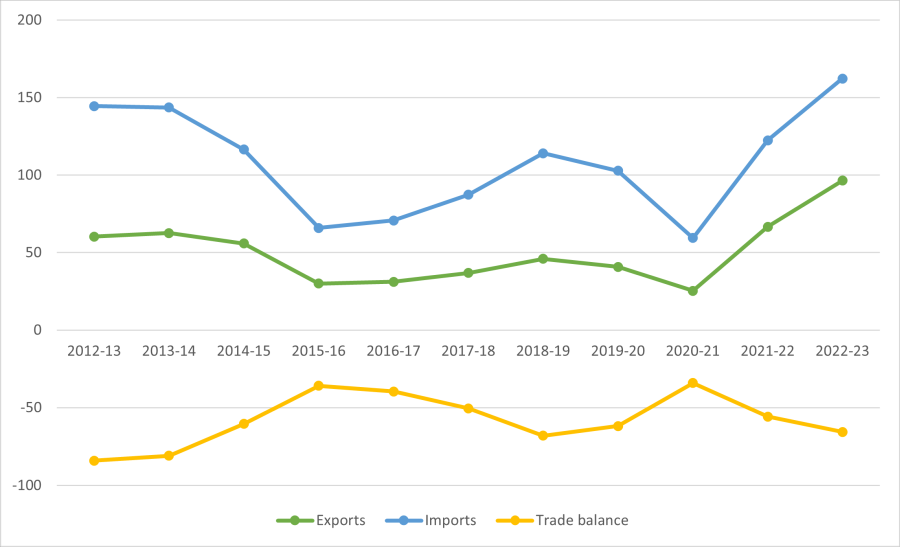

Figure 1 shows the performance of petroleum and crude oils – HS 2709 for India’s imports and HS 2710 for exports. The performance of oil exports is closely linked to the prevailing crude prices, and has displayed a surge over the last two years with rising global prices owing to the Russia-Ukraine war.

Figure 1. India’s overall oil trade, 2012-13 to 2022-23 (in billion US$)

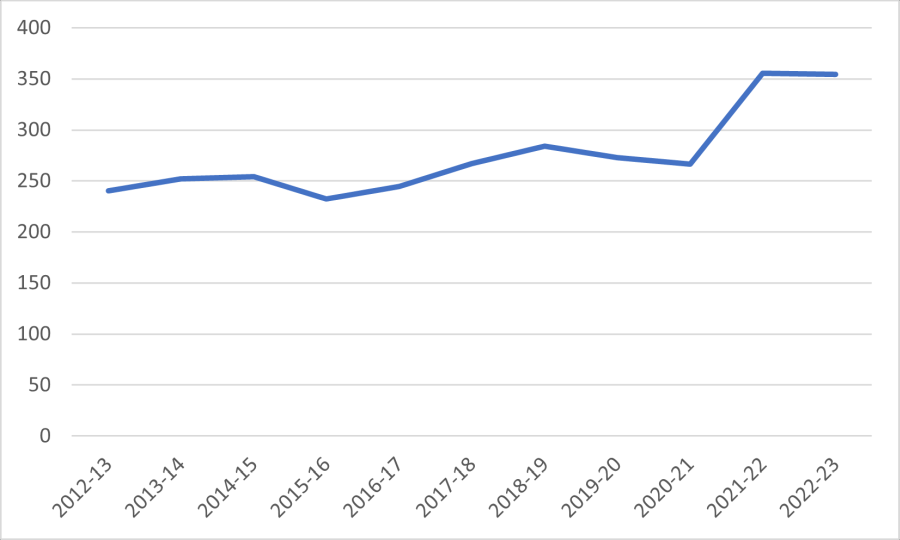

On the other hand, India’s total non-oil exports have remained range-bound over the last decade, except for 2021-22, when post-Covid global demand surged (Figure 2).

Figure 2. India’s total non-oil exports, 2012-13 to 2022-23 (in billion US$)

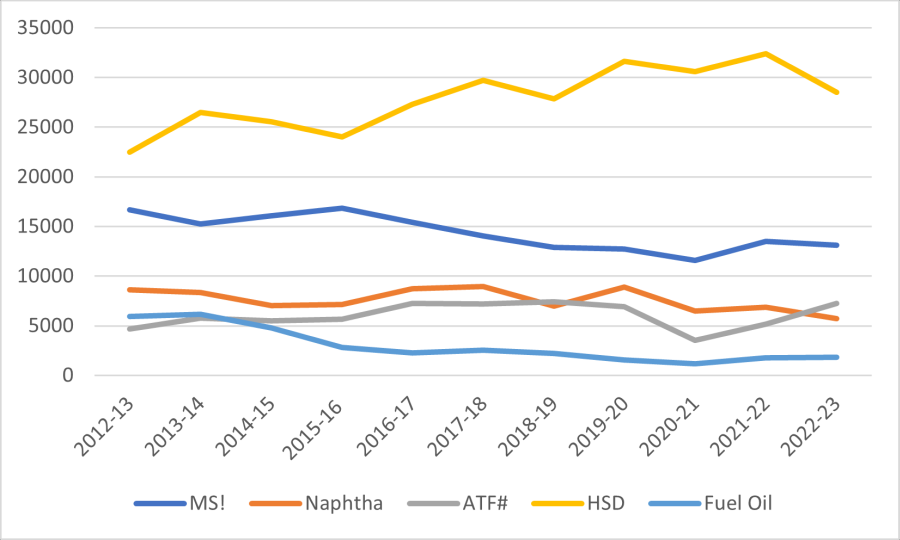

However, petroleum products have not displayed a rising trend in terms of volumes, and the change in value appears mostly due to changing oil prices. From 2021-22, only Aviation Turbine Fuel (ATF) has shown a definite upward trend, while high-speed diesel (HSD), Motor Spirits (MS) and naphtha have declined.

Figure 3. India’s key petroleum exports by volume, from 2012-13 to 2022-23 (in 1000 metric tonnes)

Concerns about India’s reliance on oil exports

The high share of petroleum products in India’s exports is a concern for various reasons.

First, India is not a major oil producer, ranking only 22nd in global oil production in 2022 with a 0.8% share of global output. It is, however, the third largest oil consumer in the world, with imports making up 88.3% of its total consumption of fuels in in the first quarter of 2023-24, up from 87.4% in FY2022-23 . While India is also the fourth largest oil refiner in the world and the largest exporter of refined oil in Asia, but with its oil demand slated to increase by almost 50% in 2030, it is likely to place pressure on future oil exports.

Second, oil prices are volatile and unpredictable due to geopolitical and production decisions. Such unpredictability greatly vitiates India’s overall export efforts, which are often driven by its oil exports. Third, while petroleum product export values reached new peaks over FY2022-23, in terms of volume, a decline is visible over the last decade in most categories of petroleum products. This implies that capacity may not have sufficiently expanded to drive exports.

Fourth, in recent years, sanctions have been imposed by leading economies on oil trade. This has affected India’s overall oil import and export stability. For example, Iran was India’s third largest supplier of mineral fuels in 2018, providing imports of US$ 13.3 billion, but due to sanctions on the country, India had to cut down imports to about US$ 42 million in 2021. The windfall gains from availability of Russian crude following sanctions on exports of Russian oil due to the Ukraine conflict are also unexpected and therefore might be considered temporary.

Fifth, the high export value of oil arising from higher oil prices tends to distract attention of policymakers from attempting to expand exports of other products. For example, in FY2022-23, India’s total exports were estimated at a peak value of US$ 447.5 billion, with growth at around 14% over the previous year. Non-oil exports, however, remained slightly below the 2021-22 level.

Finally, since oil exports are a high-value product, they have a smaller impact on developing manufacturing and employment. Being a highly capital-intensive sector and dependent on crude oil production in other countries, the impact on employment is low. For example, in India the employment in oil and gas public sector enterprises declined from 1.10 lakhs in 2017 to 0.95 lakhs in 2022, despite higher production (Ministry of Petroleum and Natural Gas, 2022).

Oil exports add hugely to the country’s foreign exchange balance and trade stability and are an essential component of India’s growth requirements. However, the volatility and uncertainty in oil exports have a significant bearing on the country’s macroeconomic stability and growth prospects. Analysts estimate that if the crude oil price rises by 10%, domestic inflation (as measured by consumer price index (CPI)) could be higher by 15 basis points (Nahata 2023). Persistent elevated inflation has the potential to invite higher interest rate decisions by the Reserve Bank of India and thereby affect growth.

Deft diplomatic handling of the vagaries of oil trade in recent months has protected India’s economic fundamentals. The surge in oil imports from Russia is a case in point, where India managed to source crude oil from the country despite Western sanctions, undertake value addition, and then export the refined product to Europe, which was facing the brunt of energy shortage owing to the Ukraine conflict. Maintaining good relations with both Russia and the Western countries, India was able to turn the crisis to its advantage. However, this may not always be the case and a greater balance between oil and non-oil exports, with the former comprising a smaller share of the total, would help support a stable Indian economy.

Direction of India’s oil trade

Looking at the sources and destinations of India’s oil imports and exports, a marked shift can be observed over the years (Table 2). The fallout of the Ukraine conflict was markedly visible in 2022-23, as India’s imports from Russia surged on account of discounted crude made available in a bid to find buyers outside of its traditional trade partners that had imposed sanctions. India’s imports from Russia therefore went up by more than 11.5 times over the year.

Table 2. India’s top 10 oil import sources (HS 2709), 2021-22 & 2022-23 (in million US$)

|

Country |

2021-22 |

2022-23 |

% growth |

|

Iraq |

30,342.10 |

33,599.57 |

10.74 |

|

Russia |

2,470.91 |

31,024.66 |

1,155.59 |

|

Saudi Arabia |

22,869.27 |

29,077.41 |

27.15 |

|

United Arab Emirates |

12,304.83 |

16,840.67 |

36.86 |

|

USA |

11,319.84 |

10,181.72 |

-10.05 |

|

Kuwait |

7,943.04 |

8,024.61 |

1.03 |

|

Nigeria |

8,591.21 |

6,059.58 |

-29.47 |

|

Angola |

1,979.47 |

3,175.05 |

60.4 |

|

Mexico |

3,419.57 |

2,844.70 |

-16.81 |

|

Oman |

3,600.00 |

2,657.57 |

-26.18 |

|

Total imports from top 10 countries |

104,840.24 |

143,485.54 |

37% |

|

Share of top 10 in total HS 2709 imports |

65% |

88% |

On the export side as well, India saw a shuffling of its top destinations as it emerged as the largest source of oil for Europe, which curtailed direct imports from Russia (Table 3). For several export destinations, the surge in oil exports contributed the highest increase in value of total exports to that country – for example, total exports to Brazil expanded by 52% during the year, the large majority of which came from mineral fuels.

Table 3. India’s top 10 oil export destinations (HS 2710), 2021-22 and 2022-23 (in million US$)

|

Country |

2021-22 |

2022-23 |

% Growth |

|

Netherlands |

5,272.13 |

12,524.61 |

137.56 |

|

United Arab Emirates |

5,702.57 |

8,047.83 |

41.13 |

|

USA |

5,061.08 |

6,026.55 |

19.08 |

|

Israel |

1,626.27 |

5,501.73 |

238.3 |

|

Togo |

2,432.92 |

5,431.92 |

123.27 |

|

Singapore |

6,099.06 |

4,720.00 |

-22.61 |

|

Brazil |

1,267.02 |

4,474.52 |

253.15 |

|

Indonesia |

2,315.85 |

3,875.24 |

67.34 |

|

South Africa |

1,420.16 |

3,739.02 |

163.28 |

|

Turkey |

2,175.26 |

3,221.61 |

48.1 |

|

Total exports |

33,372.32 |

57,563.03 |

72% |

|

Share in total exports of HS 2709 |

50% |

60% |

Observations on India’s balance of trade and policy suggestions

The fluctuations in global oil prices and the impact of geopolitical developments on their performance raise questions about the resilience of India’s reliance on oil exports. The current conflict in West Asia further places India’s oil sources and destinations at risk. It is noteworthy that India’s oil and gas production over the last ten years has been on a downward trend – the state-run ONGC Videsh, which has 32 oil and gas projects in 15 countries, has seen a decline in production from its fields (ONGC Videsh, 2023). However, consumption is on the rise. Therefore, going forward, mineral fuel exports may continue to face pressure from domestic consumption requirements, even as the export imperative will be heightened due to the need for foreign exchange for oil imports.

To ensure stability of its exports, India may consider the following policy actions.

First, it should intensify and accelerate the four-pronged strategy relating to energy security outlined by the Government, which is: (i) diversification of import sources, (ii) stepping up exploration and production of oil and gas domestically, (iii) expanding capacity of non-fossil fuel sources of energy, and (iv) accelerating transition to gas and green hydrogen.

Ease of doing business, fostering innovation, addressing trade regulations, and taking up government-to-government agreements would further aid the production effort.

Two, there is a need to continuously expand oil exports as that helps to balance the oil import requirements partly and manage oil price fluctuations. Although oil product trade is often determined by geopolitical considerations, India may consider expanding its markets to some of the top importing countries of petroleum, including Singapore, Mexico, Malaysia, and European countries such as the UK, France and Belgium.

Three, India needs to build up manufacturing and exports of other products, which is necessary to achieve multiple economic and strategic objectives, including financing purchases of future oil imports. Continued focus on expanding manufacturing and driving competitiveness for export is the need of the hour in general.

Four, the current surge in India’s oil exports is due to its access to Russian crude, which other countries are currently avoiding on account of sanctions. At some point, it will need to compete with other countries for Russian oil supplies again, as the price cap and restrictions on transport and insurance applied through sanctions may be removed. Therefore, it must continue to expand its partnerships1 for oil exploration and production overseas.

Five, India has been able to drive exports in new categories such as ATF and vacuum gas oil, where it previously had a lower presence in the global market. The higher value-added petroleum products should be prioritised. Finally, on the import side, India should attempt to curtail its purchases of value-added petroleum products as Grade HV, motor gasoline, light naphtha, etc., which could be produced within the country.

Conclusion

The current high share of oil exports in India’s total exports may be an aberration; however, even in the past, oil has been a large contributor to India’s exports, while non-oil exports have remained stagnant until the post-Covid rise in demand.

However, the resilience of non-oil exports is fragile, given the current global demand, and the longer-term green transition. Therefore, a double-pronged strategy of expanding petroleum product exports on the one hand, while going beyond oil as an export commodity on the other hand, would be in order.

Views expressed in this article are personal.

Note:

- State-run ONGC Videsh, which has 32 oil and gas projects in 15 countries, has seen a decline in production from its fields in 2022-23.

Further Reading

- Ministry of Commerce and industry (2023), ‘India’s Foreign Trade: September 2023’, Press Release, Department of Commerce, Economic Division. Available here.

- Ministry of Petroleum and Natural Gas (2022), ‘Indian Petroleum and Natural Gas Statistics 2021-22’, Report, Ministry of Petroleum and Natural Gas, Economic and Statistics Division.

- Nahata, P (2023), ‘What Crude At $90 A Barrel Means For The Indian Economy’, NDTV Profit, 7 September.

- ONGC Videsh (2023), ‘Defining Sustainable Paths for Energy Excellence: Annual Report 2022-23’.

22 January, 2024

22 January, 2024

Comments will be held for moderation. Your contact information will not be made public.