While it is true that the Indian corporate debt market has transformed itself into a much more vibrant trading field for debt instruments from the elementary market that it was about a decade ago, there is still a long way to go. This column systematically lays down the issues and challenges facing the corporate debt market in India.

At the current time, when India is endeavouring to sustain its high growth rate, it is imperative that financing constraints in any form be removed and alternative financing channels be developed in a systematic manner for supplementing traditional bank credit. While the equity market in India has been quite active, the size of the corporate debt market1 is very small in comparison to not only developed markets, but also some of the emerging market economies in Asia such as Malaysia, Thailand and China. A liquid corporate debt market can play a critical role by supplementing the banking system to meet the requirements of the corporate sector for long-term capital investment and asset creation.

Current status

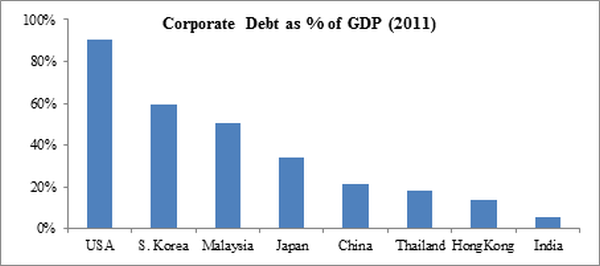

According to the Securities and Exchange Board of India (SEBI) database, outstanding corporate bonds amounted to around Rs. 9 trillion ($147 bn approx.) in 2011 making it nearly 10.5% of Gross Domestic Product (GDP) (SEBI 2012), whereas the proportion of bank loans to GDP in India is approximately 37%. In contrast, as seen in Figure 1 below, outstanding corporate bonds are close to 90% of GDP in US where the corporate debt market is most developed and bond market financing has long replaced bank financing as a funding source for the corporates; around 34% in Japan and close to 60% in South Korea (Bank for International Settlements (BIS 2012). In terms of size, as of 2011, the Indian corporate debt market was close to 7% of that of China and 15% of that of South Korea (BIS 2012).

Figure 1. Cross-country comparison of corporate debt:GDP ratios

Source: BIS (2012), World Bank Database (2012).

Source: BIS (2012), World Bank Database (2012).

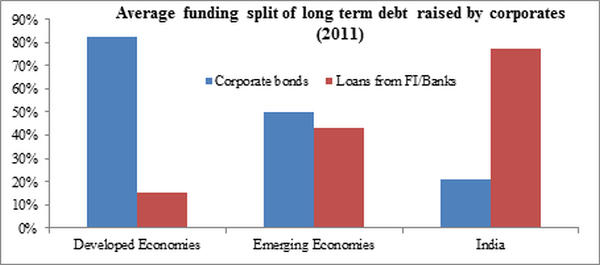

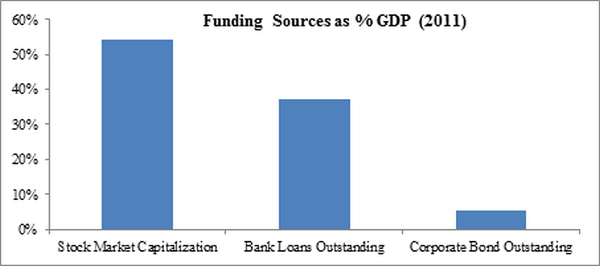

A comparison of corporate funding split with other economies shows a higher reliance of India on loans from banks and other financial institutions (Figure 2). Traditionally, bank finance coupled with equity markets and external borrowings has been the preferred funding source for Indian corporates (Figure 3). The long-term debt market consists largely of government securities (G-Secs). In 2011, in terms of size, Indian corporate debt market stood at Rs. 9 trillion ($147 bn approx.) which was only 31% of G-Secs, the outstanding issuances of which stood at a staggering Rs. 28,427 billion ($464 bn approx.) (SEBI 2012).

The figures and statistics potentially demonstrate a huge funding gap that can be bridged by developing a well-functioning corporate bond market. Among other things, as India aims to regain its erstwhile high growth rates of the early 2000s, there is bound to be a lot of pressure on infrastructure financing which is currently done primarily through budgetary support or bank credit and this is where a well-developed corporate debt market can play a significant role. According to the 12th Five-Year Plan, during 2012-2017, $1 trillion is supposed to be spent on infrastructure projects in India and for this the infrastructure companies could tap the corporate bond market to raise long-term capital instead of depending on the banking sector that is already overstretched and burdened with non-performing assets. However the corporate bond market itself faces several challenges.

Figure 2. Funding split of long-term debt raised by corporates, 2011

Source: BIS (2012), World Bank Database (2012).

Source: BIS (2012), World Bank Database (2012).

Figure 3. Comparison of funding sources in India, 2011

Source: BIS (2012), World Bank Database (2012).

Source: BIS (2012), World Bank Database (2012).

Main issues

Some of the constraints facing the Indian corporate debt market are structural while some emanate from regulatory roadblocks. In our research, we have systematically categorised these issues into supply-side, demand-side, secondary-market and risk hedging related, and have made an attempt to explore each of these in detail (Sengupta and Anand 2014).

Development of the domestic corporate debt market in India is thwarted by a number of factors, the prominent ones being low primary issuance of corporate bonds leading to illiquidity in the secondary market, narrow investor base, high costs of issuance, lack of debt market accessibility to small and medium enterprises, dearth of a well-functioning derivatives market that could have absorbed risks emanating from interest rate fluctuations and default possibilities, excessive regulatory restrictions on the investment mandate of financial institutions, large fiscal deficit, high interest rates and the dominance of issuances through private placements and AAA2 rated bonds which in turn also prevent retail participation and aggravate the dependence on bank financing.

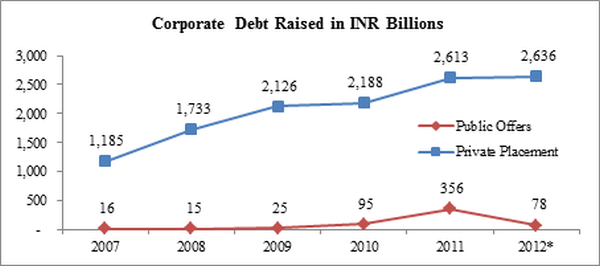

Total corporate bond issuance in India is highly fragmented because bulk of the debt raised (more than 90% of the issuances) is through private placements3. Corporates typically circumvent the private placement investor cap by making multiple bond issuances for multiple groups of 49 investors4. In 2005, a High Powered Expert Committee (HPEC) on Corporate Bonds and Securitization was formed under Dr. R. H. Patil. The Patil Committee Report (Patil 2005) highlighted ease of issuance, cost efficiency and institutional demand as key reasons for the dominance of private placements. The disclosure requirements for debt securities are provided by the SEBI Issue and Listing of Debt Securities Regulations 2008. While the private placement disclosure and documentation requirements are viewed by the market to be comprehensive, disclosure requirements for public issuance of debt are viewed by the market as being extremely onerous and difficult to comply with.

Figure 4. Private vs. public placements in Indian corporate debt market

Source: SEBI (2012).

Source: SEBI (2012).

Apart from the supply-side constraints, there are also several demand-side issues. For instance, the investment norms of insurance companies, banks and pension funds in India are heavily skewed towards investment in government and public sector bonds.

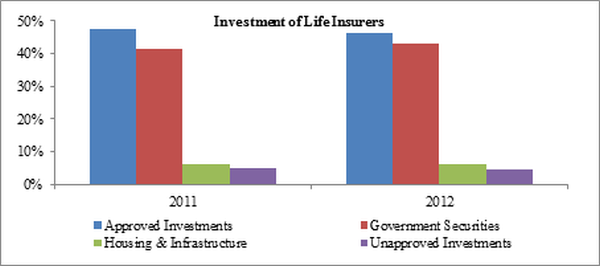

Under the eligible Statutory Liquidity Ratio (SLR) investments, banks are required to hold 24% of their liabilities in gold, cash and government securities. Insurance Regulatory and Development Authority (IRDA) Investment Amendment Regulations, 2001, which covers life insurance, pension and general annuities, unit linked life insurance, general insurance and re-insurance businesses, mandates that life businesses require that at least 65% of assets be held in various types of public sector bonds; non-government investments, if allowed, may not exceed 15% in unapproved assets and approved assets do not include corporate bonds rated below AA. As a result, a major part of investments for life and pension businesses is being held in G-Secs and other approved securities, which are relatively safe instruments (Figure 5). In practice, insurance companies hold less than 7% in unapproved assets.

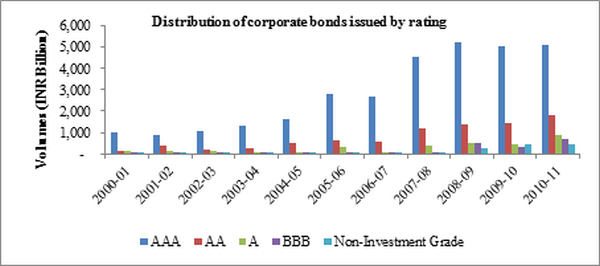

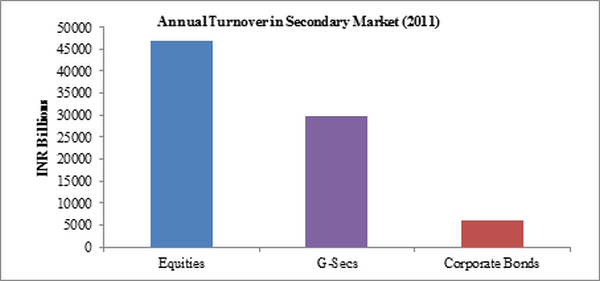

Furthermore, the market preference for very safe AA and above rated assets has resulted in a thin market for lower rated bonds (Figure 6). This has resulted in the exclusion of small and medium enterprises, which are generally rated below investment grade of BBB, from the debt market. The secondary market activity is also marginal with most of the volumes dominated by the top 5-10 names. Thus, the corporate debt market in India faces a ‘chicken-and-egg’ dilemma with a shallow secondary market failing to beget a healthy demand among the investors, thereby resulting in lower volumes and vice versa. Although the trading volumes have increased in the recent times, they are significantly smaller than those in G-Secs and equities (Figure 7). The secondary market activity is hampered by issues such as absence of market makers and liquidity, lack of pricing and benchmarks, and small institutional investor base.

Figure 5. Break-up of investment of life-insurance companies

Source: IRDA (2013).

Source: IRDA (2013).

Figure 6. Corporate bond issuance by ratings

Source: SEBI (2012).

Source: SEBI (2012).

Figure 7. Break-up of secondary market turnover

Source: RBI (2012), SEBI (2012).

Source: RBI (2012), SEBI (2012).

Finally, the Indian corporate debt market is also constrained by lack of adequate risk management products, be it credit default swaps (CDS) or interest rate futures (IRF)5.

Conclusion

Development of long-term debt markets is critical for the mobilisation of the huge magnitude of funding required to finance potential businesses as well as infrastructure expansion. Despite a plethora of measures adopted by the authorities over the last few years, India has been distinctly lagging behind other developed as well as emerging economies in developing its corporate debt market. The domestic corporate debt market suffers from deficiencies in products, participants and institutional framework.

For India to have a well-developed, vibrant, and internationally comparable corporate debt market that is able to meet the growing financing requirements of the country’s dynamic private sector, there needs to be effective co-ordination and co-operation between the market participants that include investors and corporates issuing bonds as well as the regulators. Issues such as crowding of debt markets by government securities cannot be addressed by market participants and regulators alone. Better management of public debt and cash could result in a reduction in the debt requirements of the government, which in turn would provide more market space and create greater demand for corporate debt securities.

Clearly, the market development for corporate bonds in India is likely to be a gradual process as experienced in other countries. It is important to understand whether the regulators have sufficient willingness to shift away from a loan-driven bank-dependent economy and also whether the corporations themselves have strong incentives to help develop a deep bond market. Only a conjunction of the two can pave the way for the systematic development of a well-functioning corporate debt market.

Notes:

- Companies meet their fund requirements through various sources - retaining business profits, issuing equity to private or public investors, taking loans from banks/financial institutions, or borrowing from private or public investors by issuing bonds. The last category of funding, wherein a corporate issues debt securities (also called corporate bonds) to individual or institutional investors through private or public channels, constitutes the corporate debt market or corporate bond market.

- The credit rating of a bond assesses the credit worthiness or the ability to meet financial obligations/ commitments of the entity issuing the bond. AAA signifies the highest degree of credit worthiness.

- Corporate bonds can be issued to select qualified investors (usually banks, financial institutions, funds etc.) through the ‘private placements’ route. When bonds are offered to the whole market, it is called public placement. Public placements have traditionally been slower and costlier due to stringent disclosure requirements as compared to the private placements.

- The SEBI Issue and Listing of Debt Securities Regulations 2008 prescribes that an issue is qualified as private only if offered to less than 50 persons.

- A Credit Default Swap (CDS) on a corporate bond is a credit derivate contract between two counterparties where the CDS seller is obliged to pay the CDS purchaser an amount equal to the value of the bond in the event of default by the bond issuer. In return the seller receives regular predetermined payments from the purchaser. It is a standard instrument used to hedge risk in corporate debt markets. A corporate debt market also suffers from an inherent interest rate risk in a deregulated interest rate environment. A way to hedge against such a risk is to use an interest rate future (IRF). It is a financial derivative based on an underlying security that moves in value as interest rates change.

Further Reading

- Bank of International Settlements (2012), ‘Debt Securities Statistics’.

- Goldman Sachs (2007), ‘Bonding the BRICs: A Big Chance for India’s Debt Capital Market’, Goldman Sachs Economic Research, Goldman Sachs.

- IndiaStat (2012),‘Govenment Securities’.

- Jiang, G., Tang, N. and E. Law (2002), ‘The development of bond markets in emerging economies’, BIS Working Paper 11, 103-114.

- Kataria, T. (2010), “Indian Corporate Bond Market”, Banking & Finance Journal(1):14.

- Patil, R.H. (2005), ‘Report of High Level Expert Committee on Corporate Bonds and Securitization’, Ministry of Finance.

- Raghavan, S. (2012), “Corporate Bond Market in India: Lessons from Abroad and Road Ahead”, International Journal of Trade, Economics and Finance, 3(2):120-125.

- RBI (2012), ‘RBI Database’, Retrieved 2012, from Database on Indian Economy.

- RBI Handbook (2012), ‘Handbook on Statistics on Indian Economy’, RBI.

- Reinhart, C.M. and K.S. Rogoff (n.d.), ‘Debt to GDP Ratios by Country’, Retrieved 02 20, 2013, from

- SEBI (2010) ‘Annual Report’, SEBI.

- SEBI (2012), ‘Corporate Bonds’.

- SEBI Handbook, (2012), ‘Handbook of Statistics on Indian Securities Market’,

- Sengupta, R. and V. Anand (2014), ‘Corporate Debt Market in India: Issues and Challenges’, forthcoming in India Development Report. SEBI.

- World Bank (n.d.), ‘World Data Bank’, Retrieved Dec 2012, from World Data Bank.

19 May, 2014

19 May, 2014

Comments will be held for moderation. Your contact information will not be made public.